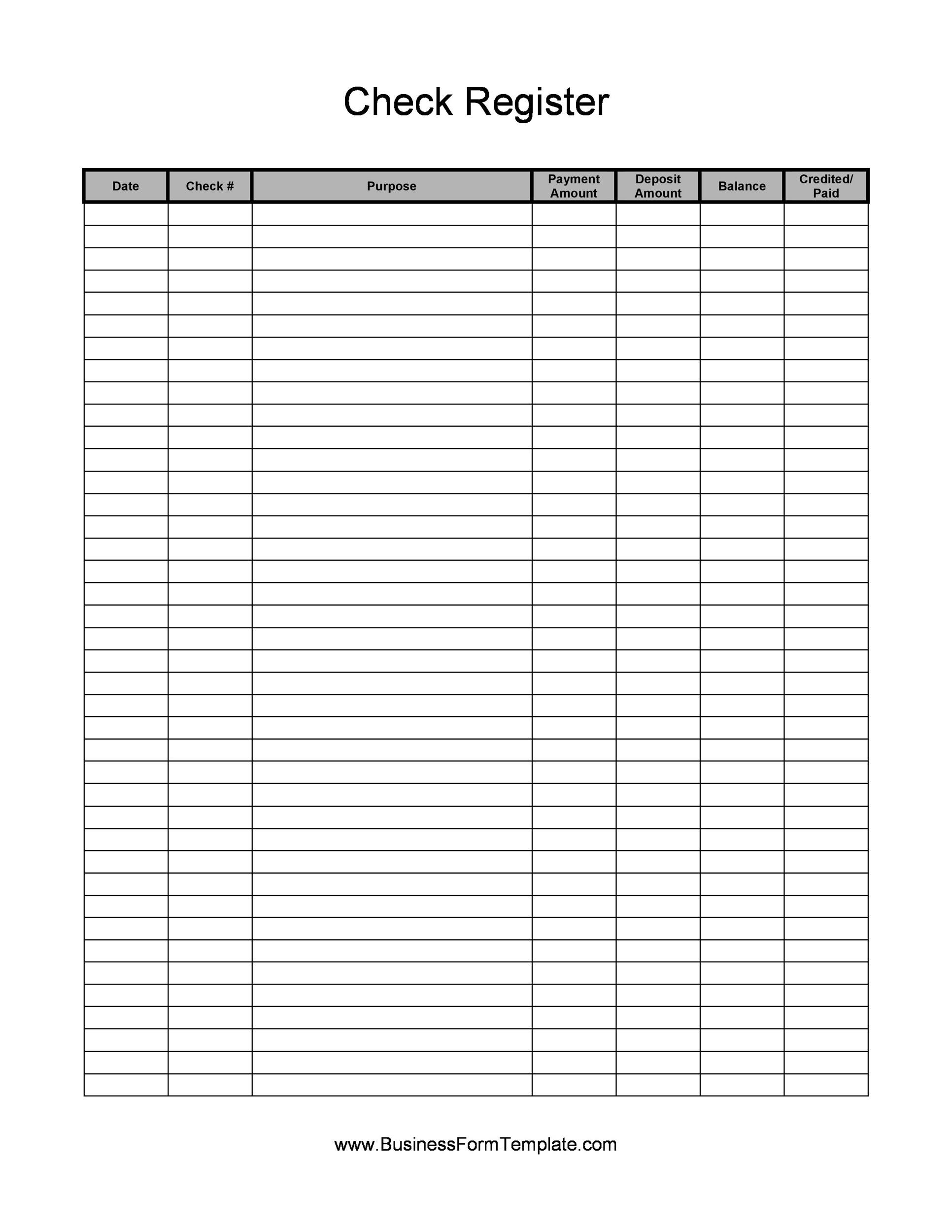

It is highly recommended to record every financial operation when it is completed, when it is still fresh in your memory to avoid mistakes and misunderstandings in the future. To do so, compare your Check Register with the bank statement. Once a month, or more frequently if you like, you need to reconcile your financial records with the official statement you receive from your bank.

This financial statement will let you keep track of your transactions, and you will always know how much money is left in your account. It contains a complete record of all credit and debit operations, incoming and outgoing transactions associated with the bank account.

A Checkbook Register is a list of deposits and withdrawals to and from your checking account.

0 kommentar(er)

0 kommentar(er)